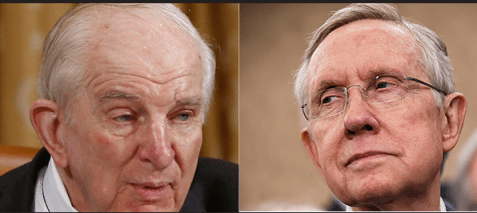

SHOWDOWN: U.S. Rep. Sam Johnson, R-Texas, left, wants to end the practice of giving illegal immigrants tax credits for kids, but U.S. Sen. Harry Reid, D-Nev., won’t let the House-approved measure through the Senate.

By Kenric Ward | Watchdog.org

WASHINGTON, D.C. — The House of Representatives repeatedly has passed an IRS bill that could save U.S. taxpayers up to $24.4 billion over the next 10 years — but Harry Reid’s Democratic Senate will not hear it.

The Refundable Child Tax Credit Eligibility Verification Reform Act, or H.R. 556, would require tax filers to provide Social Security numbers to claim child tax credits.

Currently, the IRS allows undocumented residents to collect the $1,000 credits for dependents not even living in the country. Watchdog reported that illegal immigrants received $4.2 billion from the tax agency in just one year.

“My bill (targets) billions of dollars in waste, fraud and abuse. Instead of hitting up taxpayers for even more taxes, Washington needs to go after these billions of dollars,” said U.S. Rep. Sam Johnson, R-Texas.

Though the GOP-controlled House has passed Johnson’s measure three times, Senate Majority Leader Reid, D-Nev., refuses to allow the bill to come up for a vote in his chamber.

This, despite the fact that the Joint Committee on Taxation calculates that enactment of H.R. 556 would save taxpayers $24.4 billion over the next decade.

To enhance the bill’s chance of passage in the Senate, House leaders might fold it into the overall budget package and turn up the heat on Reid.

The IRS maintains it cannot discriminate between legal and illegal residents, but the agency does make that distinction when awarding Earned Income Tax Credits to low-wage filers.

Johnson said Congress expected due diligence for the Additional Child Tax Credit, given the 1996 Welfare Reform law signed by President Bill Clinton.

“The IRS has been doling out the credit to tax filers claiming children who do not even live in the country,” Johnson charged.

Tax preparers agree that the system is broken — and that the IRS must fix it. They say the agency has to stop disbursing ACTC refunds based on Individual Taxpayer Identification Numbers, which are available to undocumented residents.

Technically, the IRS requires birth certificates, passports or other official documents to issue an ITIN. But the agency does not demand proof that the dependents reside in the United States, or that they are even living with the tax filer.

That loophole has allowed recipients to game the system, improbably collecting thousands of ACTC refunds at single addresses.

Tax preparers told Watchdog they have seen clients from Guatemala, El Salvador, Honduras and Nicaragua claiming Mexican children as dependents.

Johnson said the number and dollar amount of improper payments from child tax credits has skyrocketed, enabling illegal immigration.

A 2011 report by the Treasury Inspector General for Tax Administration determined that $4.2 billion in such credits were paid in 2010 to 2.3 million ITIN filers here illegally.

A 2009 TIGTA audit concluded that the child tax credit “appears to provide an additional incentive for aliens to enter, reside, and work in the U.S. without authorization, which contradicts Federal law and policy to remove such incentives.”

U.S. Sens. Charles Grassley, R-Iowa, and Mike Enzi, R-Wyo., have sought unsuccessfully Senate legislation to bar the use of ITINs in claiming child tax credits.

Johnson’s bill would impose a 10-year ban on tax filers who commit fraud and a $500 penalty on tax preparers who knowingly bilk taxpayers through the ACTC program.

Amid the billions in annual IRS payouts to illegal immigrants, Sen. Reid – who advocates for what he calls “comprehensive immigration reform” — is unmoved.

“I just think the child tax credit is working just fine, and there’s no need to punish children,” the Democratic leader told the Associated Press in February.

The IRS did not respond to Watchdog’s request for comment.

Last June, testifying at a House Ways and Means Committee hearing, Acting IRS Commissioner Daniel Werfel admitted that widening use of ITINs is costing taxpayers because the numbers can be used to fraudulently obtain tax refunds.

VIEW VIDEO OF WERFEL’S TESTIMONY HERE.

Kenric Ward is a national reporter for Watchdog.org and chief of its Virginia Bureau. Contact him at kenric@watchdogvirginia.org or at (571) 319-9824. @Kenricward

Harry Reid is a piece of garbage just like Nancy Pelousi and our socialist president

Comments are closed.