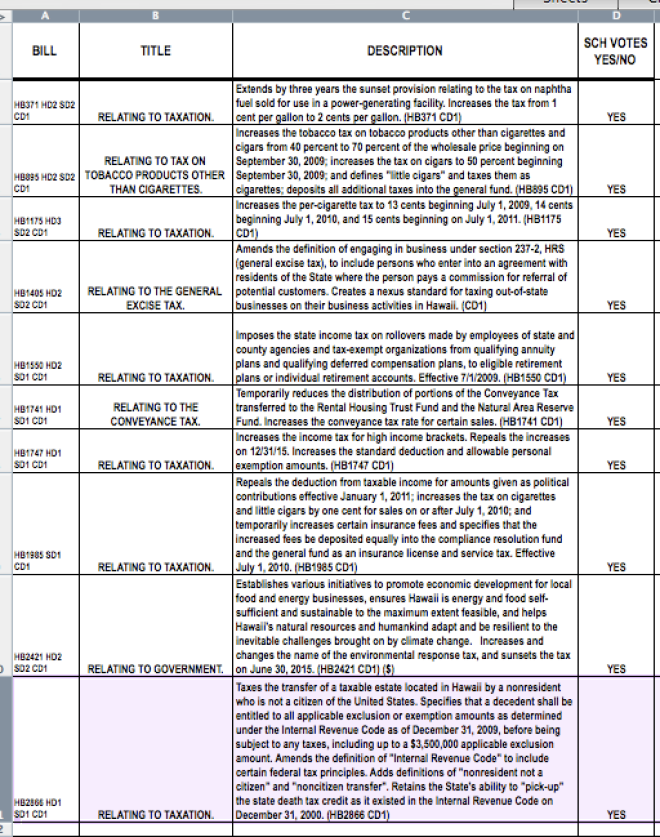

BY HAWAII REPORTER STAFF – Colleen Hanabusa, Hawaii State Senate president, supported state tax increases 10 times in the last two years at the Hawaii State Legislature, the above analysis shows. She didn’t return an email from Hawaii Reporter today to explain or defend her voting record, which opponents say raised the cost of living in Hawaii for all local families.

Congressman Charles Djou, R-HI-1, who hopes to hold onto his seat that he won May 22 in a three-way special election, has made Hanabusa’s tax hike history part of his television ad campaign showing why voters should oppose her and support him.

He has opposed all tax hikes while in the Honolulu City Council, Hawaii State Legislature and most recently, in Congress. In addition, he signed the Americans for Tax Reform pledge not to support or introduce any tax increase legislation while in office.

The tax hikes that passed on Hanabusa’s watch increased the cost of doing business and living in Hawaii, says Sen. Sam Slom, R-Hawaii Kai, – Diamond Head. Slom, who in the off election season regularly debates Hanabusa on KHVH News Radio via the Rick Hamada show.

Slom says in the Senate where most of these tax proposals originated, Sen. Fred Hemmings, R-Kailua, and he spoke out several times about the negative impact these tax hikes would have on these already overtaxed individuals, families and small businesses.

“At a time when Hawaii continues to struggle economically and jobs are a major concern for everyone, it was absolutely suicidal to pass more of these taxes. These tax hikes lower everyone’s standard of living and send a further negative signal to those businesses and investors who want to create new opportunities and jobs that they cannot afford to do so in Hawaii,” Slom says.

Hanabusa oversees 23 Democrats and 2 Republicans in the 25-member body. The largest tax hikes gaining the majority vote raised personal income tax to the highest rate in the nation, according to Kail Padgitt of the Washington DC-based Tax Foundation. “The top marginal tax rate of 11% stands out as the highest in the country,” Padgitt says.

Other taxes that impact everyone in Hawaii, Slom says, are the barrel tax on imported petroleum products and the unemployment compensation tax on every business. “The majority party added more taxes on the petroleum barrel tax even though everyone knows we are the most petroleum dependent state in the nation. … If the majority party leadership had gotten their way, we would now be taxing the Internet, raising the regressive General Excise Tax even more and putting further disincentives on those who are the most productive in the state. The worst part is the tax increases have been cumlitive in the past 5 years, driving up the cost of food, medical premiums, rents and all other necessities for Hawaii’s families.”

[…] Barack And Michelle Obama’s HALLOWEEN Spectacular Peace FM Online The Presidential Planner ABC News (blog) KBOI – Mirror.co.uk all 374 news articles » Hawaii Reporter […]

Comments are closed.