REPORT FROM THE US ATTORNEY GENERAL – WASHINGTON – Francis E. Chandler III was sentenced by U.S. District Judge Susan Oki Mollway late yesterday to serve 37 months in prison and ordered to pay $3,066,629 in restitution for filing a false claim for tax refund and false retaliatory liens against four federal government officials, the Justice Department and Internal Revenue Service (IRS) announced today.

According to court documents, Chandler filed a fraudulent 2007 federal income tax return seeking a tax refund of $3,969,012 based on his false claim of interest income and tax withholding of $6,222,850.

In April 2010, a federal grand jury indicted Chandler for filing the false claim against the United States.

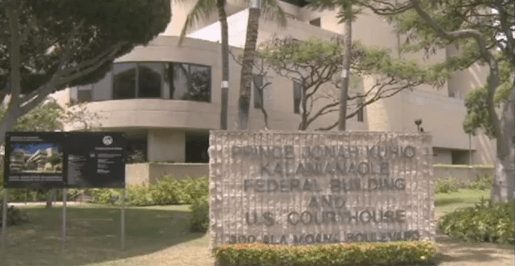

Shortly after his indictment and in retaliation for the performance of their official duties, Chandler knowingly filed false liens in Hawaiian public records against the property of two federal judges, the U.S. Attorney and an Assistant U.S. Attorney who were involved in the prosecution of his false claims case.

On Feb. 11, 2013, pursuant to a plea agreement, Chandler pleaded guilty to one count of filing a false claim against the United States and one count of filing a false retaliatory lien against four government officials.

“This sentence shows that those who seek to obtain fraudulent refunds by participating in bogus schemes risk prosecution, incarceration and substantial financial consequences,” said Assistant Attorney General Kathryn Keneally for the Tax Division. “This sentence should also send a loud message that retaliating against government officials who are simply doing their jobs will not be tolerated.”

“With the income tax filing deadline today, this sentencing is a stark reminder that there is no secret formula to evade one’s tax obligation,” said Special Agent in Charge Kenneth Hines of IRS-Criminal Investigation in the Pacific Northwest. “When individuals seek to abuse the tax system by claiming bogus senseless tax refunds, they steal not only from the U.S. Treasury, they in effect steal from every one of us who pays taxes. Chandler then tried to intimidate the very officials charged with upholding the law by filing retaliatory liens against them. That sort of brazen tactic is simply illegal.”

Assistant Attorney General Keneally commended the efforts of special agents of IRS – Criminal Investigation, who investigated the case, and of Tax Division Senior Litigation Counsel Jen E. Ihlo and Trial Attorney Matthew J. Kluge, who prosecuted the case.

More information about the Tax Division and its Tax Defier Initiative can be found at the division website.