REPORT FROM THE DEPARTMENT OF JUSTICE – HONOLULU — A federal jury yesterday found Mahealani Ventura-Oliver, 44, and Pilialoha K. Teves, 52, both of Maui, guilty of conspiracy and mail fraud offenses arising out of their marketing of a debt elimination scheme between 2008 and 2009. The jury also found Ventura-Oliver guilty of conspiring to submit false tax returns, and of submitting a false tax return.

Florence T. Nakakuni, United States Attorney for the District of Hawaii, said that according to evidence produced in court, Ventura-Oliver and Teves were part of a group known as Ko Hawaii Pae Aina, the Registry and Hawaiiloa Foundation. Between 2008 and 2009, the group held weekly seminars on Maui, where Ventura-Oliver and others spoke about Hawaiian history and culture, and royal land patents. The evidence showed that, in return for the payment of a fee, the group offered to provide distressed homeowners with “bonds” and other documents that would pay off their mortgages and forestall collection efforts. The “bonds” purportedly directed the United States Treasury Department or the State of Hawaii Comptroller of the Currency to make payments on behalf of the homeowners.

According to evidence presented at trial, Hawaiiloa Foundation collected approximately $468,000 from approximately 200 individuals who went through the debt elimination process. Many of the individuals tried to use the bonds, but ultimately lost their homes through foreclosure, or had to renegotiate loans.

The government presented evidence that, as part of its process, the Hawaiiloa Foundation also promoted a tax program whereby participants supposedly could seek refunds from the IRS for debts paid off with the purported bonds.

Following an 11 day trial, the jury found Ventura-Oliver guilty of conspiring to use fictitious financial instruments, 15 counts of mail fraud, one count of money laundering, one count of conspiring to submit false tax returns seeking $1.5 million in refunds from the IRS, and submitting one false tax return with her estranged husband, John Oliver, who pled guilty and testified at trial. Teves was convicted of conspiring to use fictitious financial instruments, and of 12 counts of mail fraud, and was acquitted of three counts of mail fraud.

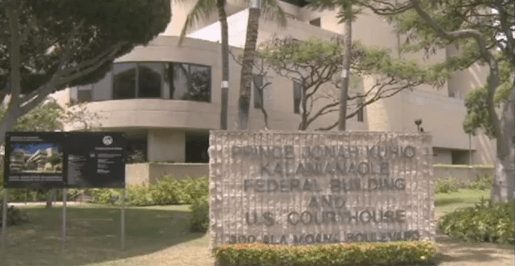

Ventura-Oliver and Teves will be sentenced on February 10, 2014 by United States District Judge J. Michael Seabright. Ventura-Oliver faces the following penalties at sentencing: (1) a maximum sentence of five years on each of the conspiracy offenses, and the

false claim offense; (2) up to 20 years on each of the 15 mail fraud offenses; and (3) up to 10 years on the money laundering offense of which she was convicted. Teves faces a maximum sentence of five years on the conspiracy charge, and up to 20 years on each of the 12 mail fraud offenses of which she was convicted. Each charge also carries a potential fine of up to $250,000.

The court will also have a hearing on whether the United States can forfeit property seized during the investigation of the case. The property includes approximately $84,000 in cash, more than $18,000 seized from bank accounts, gold coins worth over $36,000, and vehicles.

The investigation of this case was conducted jointly by the Federal Bureau of Investigation, the Internal Revenue Service — Criminal Investigation, the United States Postal Inspection Service, and the Maui Police Department. The prosecution was handled by Assistant United States Attorneys Larry Tong and Michael Nammar.